Are you already over 50 and have done little or nothing for your old-age provision? Then it is high time. Women in particular are usually only entitled to a small statutory pension due to unsteady employment histories. Without private provision, things can quickly get tight financially.

You’re probably familiar with the principle: If you work all your life and earn money, you regularly pay into the pension fund — and ultimately receive more pension than someone who works less or earns less. However, many overestimate how much pension this will ultimately be. The pension level is currently (as of July 2019) 48.2 percent. That means your retirement pension won’t even be half as much as your last salary. According to the German Pension Insurance Fund, the expected annual pension (net before taxes) for an average annual salary of 33,057 euros is 15,920 euros.

is the current pension level in Germany

And this calculation only works if you have been employed for 45 years and have always earned the average salary of all contributors. Women in particular often do not manage this. They usually earn less than men over the course of their working lives because they take care of the household, children or relatives — at least some of the time. Or because they worked in jobs where salaries are lower.

Low earnings mean little pension. Little pension means poverty in old age. How do you get out of this spiral? Women in particular are affected by poverty in old age. And not just because they pay less into the pension fund.

Another problem is that they often rely on their partners to provide for their old age. The man will take care of it, after all he earns well and can also bear the costs in old age. However, a man should never be a retirement plan. Because what happens in the event of a separation or even the death of the partner? Then women are often left with too little money.

Saving in old age — taking retirement planning in hand

Every woman who wants to live well in old age should therefore make private retirement provisions, regardless of whether she has a partner. And they should do so as early as possible. 25-year-old women have a full 42 years until retirement to supplement their own pensions. They can build long-term investment strategies and, accordingly, more capital than women around 50.

Every woman who wants to live well in old age should therefore make private pension provision, regardless of whether she has a partner.

But even in middle age, women can still start making retirement provisions — they are by no means too late. After all, it is still more than 15 years until the regular retirement age. A good period of time to invest money profitably.

At 50, you even have advantages over younger pensioners: you are financially secure, have been working in your profession for a long time, have largely paid off a house or apartment, and are freer from family obligations.

So it should be a cinch to take care of your own retirement planning, right? The following four questions will help you to quickly find out how you should proceed with your pension provision:

1. How big is your pension gap?

This first question is important. We’ve already told you that the pension level is currently 48.2 percent. However, this percentage does not tell you what that means for your pension. Nor does it tell you anything about whether you will lack money to live on in old age. So take a good look at your finances:

First, take a look at your pension information. Everyone over the age of 27 who has paid into the pension fund for at least five years receives this every year. The pension information shows you how much so-called entitlements you have already acquired. In other words, how much pension you are currently entitled to. It also contains a projection up to retirement age.

Caution: If you have already made private provision, don’t forget to include any company pension or private retirement provision.

Next, list all the expenses you will encounter in retirement. Some costs that have existed up to now will be eliminated — such as contributions to disability insurance or money for travel to work. Other costs may be added, such as for more intensive, medical care. Experts estimate that you will need about 80 to 85 percent of your last net income in retirement.

Then, contrast your expected pension with your expected expenses. Don’t be alarmed: You usually won’t be able to maintain your standard of living on your state pension alone.

2. How much time do you have until retirement?

The shorter the time until you retire, the higher the return on your private pension should be. After all, you want your money to grow as much as possible.

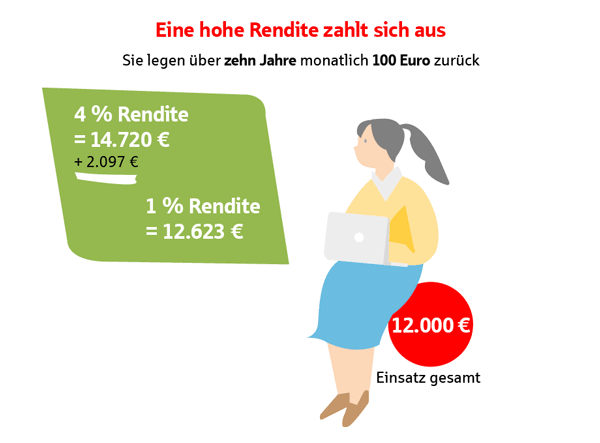

For example, you set aside 100 euros a month for retirement. With a return of one percent, you have 12,623 euros available as an additional pension after ten years — if you invest 12,000 euros. With a return of four percent, the figure is 14,720 euros for the same investment. 2,097 euros more.

However, experts advise: From the age of 50, you should not take too high a risk when investing. And these are definitely present in investment forms with high returns. While younger people can more easily cope with fluctuations on the stock market — by making up for losses over many years — there is not as much time for prospective retirees to do so.

3 How willing are you to take risks?

This question follows on seamlessly from the previous one. Expert advice is one thing. But ultimately, you decide for yourself how much risk you want to take.

Those who have a fatter wallet at their disposal may be more likely to opt for a high-risk investment. Those who are short of money anyway should play it safe and go for a solid return.

4 How much money do you currently have available for retirement?

You can’t avoid taking a look at your cash flow for this question either. How much money do you earn? How much are you currently spending? Is there anything you can save somewhere to use for your retirement savings? Be honest with yourself and calculate realistically. First, always pay off short-term outstanding balances — for example, rent, bills and loans.

«50+» — These forms of retirement planning are a good idea

Company pension plan

Are you employed? If so, you have had a statutory entitlement to a company pension through so-called deferred compensation since 2002. This means that you pay in part of your salary — or part of special payments such as Christmas bonuses — and use it to build up a supplementary pension.

You take the money out of your gross income, have less to pay in taxes and save money. Social security contributions are also lower in this way. To save 50 euros, you only pay in around 30 euros, depending on your tax rate.

Another way of saving for retirement through your employer is through so-called «Vermögenswirksame Leistungen» (VL). This benefits those with a low income in particular. Your employer pays up to 40 euros a month into a savings contract for you, for example a bank savings plan, a building society savings contract or a share savings plan. If your income remains below a certain limit, you even receive a subsidy from the state — the employee savings allowance.

Savings book

Since it is still on many people’s minds, here is our assessment of the savings book as a retirement provision: Due to the ongoing low-interest phase, it is not worthwhile to park your money there. There is simply no or only very low interest. Even the compound interest effect, from which you as a saver should normally benefit, is of no use.

Annuity insurance or life insurance

Do you want a guaranteed, additional pension for life? Then a private pension or life insurance policy could be something for you. Here, you pay into a fixed savings contract every month. The money you pay in is invested with interest. At the end of the contract, you receive a fixed annuity or your insurance company pays you the entire amount you have saved in one go.

Your advantage: Even if you do not earn much interest over the years, you will still receive the full amount paid in. This makes your financial planning calculable in old age.

Shares and funds

If you are thinking about saving today, you cannot avoid funds. Especially saving for retirement hardly works without stocks or funds if you are interested in a good return. In the long term, this is the way with the highest returns and should therefore form part of your private pension provision.

In the past, shares with a long investment horizon have yielded an average return of at least four percent — usually even more. So if you invest 100 euros a month at four percent, you can look forward to 14,720 euros after ten years.

Important: You have to take into account that prices fluctuate. So there is a possibility that they will not be at the optimal level for the start of the pension. You can sit out bad phases and wait for prices to rise. However, this only works if you don’t need to rely on the money you’ve invested right away.

You should also not put all your money into stocks. A rule of thumb for the percentage: 100 minus your age. That is, if you start retirement planning at 50, invest only 50 percent of your available money in stocks.

Would you like to take charge of your retirement planning now? Then make an appointment with your savings bank advisor. Together we will find the right retirement provision for you. For more information on saving for later, visit the Money and Household Advice Service.